Much better than anticipated PMI data for February indicate encouraging resilience of the economy in the face of headwinds which include rising interest rates, the ongoing cost of living crisis, labour shortages and strikes.

While many companies continue to report tough operating conditions, especially in the manufacturing sector, the broader business mood has been buoyed by signs of inflation peaking, supply chains improving and recession risks easing. The stress created by last autumn’s mini budget is also continuing to work its way out of the financial system.

However, while the data suggest that near-term recession odds have fallen considerably, elevated inflation pressures clearly remain a concern, especially in the service sector. As such, the resilience of the economy and the stickiness of the survey’s inflation gauges add to the likelihood of the Bank of England tightening policy further, and potentially more aggressively, which may dampen future growth expectations and suggests that the possibility of recession later in the year should not be ruled out.

Economy rebounds

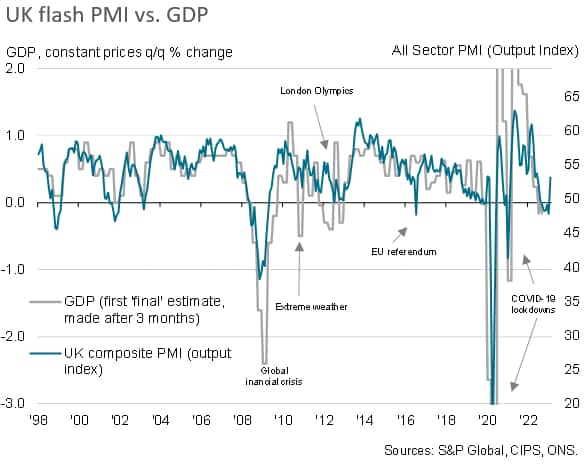

UK business activity surged back into life in February, according to the flash PMI survey data compiled by S&P Global and sponsored by CIPS, displaying renewed growth after six months of continual decline. The composite PMI rose sharply from 48.5 in January to 53.0 in February according to the provisional data, registering the strongest expansion since last June and smashing consensus expectations of a reading of 48.7, as signalled by economists polled by Reuters.

The latest reading is consistent with GDP growing at a quarterly rate of 0.3% after a 0.3% rate of contraction had been indicated for January. That leaves the signal for the first two months of the year flat on average, though with momentum clearly improving to suggest that the economy could return to growth in the first quarter as a whole after having stalled in the fourth quarter of last year and having contracted in the third quarter.

Broad-based revival

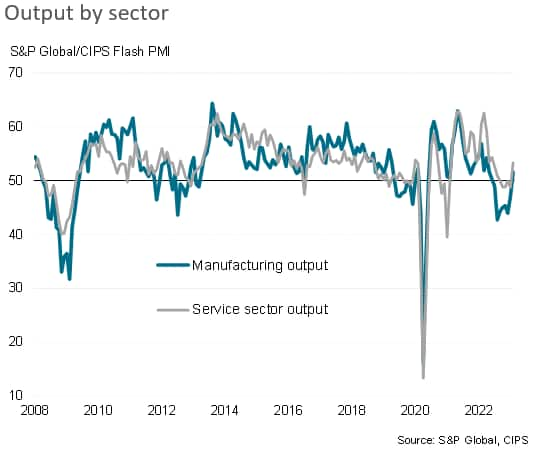

The upturn was led by the service sector, which expanded for the first time since last August and at the sharpest rate since last June, though manufacturing output also returned to growth for the first time in eight months, showing the largest expansion since last May.

In more detail, the service sector expansion was led by a resurgence of activity in the financial services sector, where demand rose for the first time since last August in a sign of business reviving after the disruptions caused by last Autumn’s mini budget.

Demand also continued to rise strongly at hotels & restaurants, reflecting reviving tourism and warmer than usual weather, but transport remained subdued, in part reflecting industrial action. Demand for business services also rose, expanding at the steepest rate for nearly a year, reflecting the broader economic upturn.

In manufacturing, business conditions have improved most perceptibly in sectors such as electronics, business machinery and autos, where supply chain constraints for components such as semiconductors have eased. In contrast, underlying demand remains under pressure in more primary industries and energy-intensive sectors, such as chemicals, plastics and timber products, as well as clothing, often reflecting inventory reduction policies.

Brighter leading indicators

There was also positive news from the survey’s sub-indices.

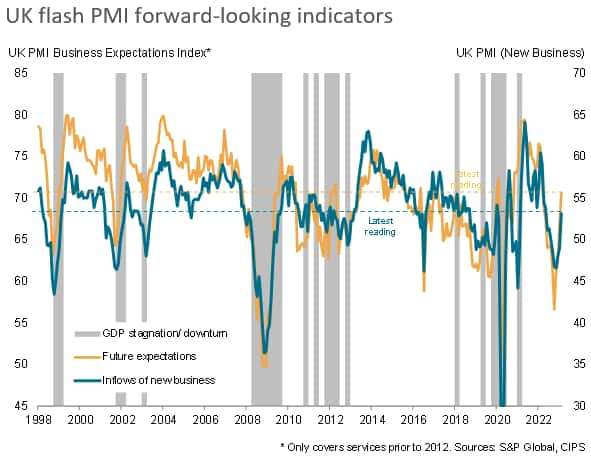

First, new orders increased for the first time since last July, rising at the sharpest rate for nine months to signal resurgent demand. Although the improvement in demand was confined to the service sector, where new business inflows rose for the first time since last August thanks in part to reviving exports, the downturn in manufacturing orders cooled to the weakest recorded over the past nine months.

Second, business optimism for the year ahead rose to an 11-month high, recovering further from the low plumbed in October in the aftermath of the Truss-Kwarteng budget. Optimism hit a 12-month high in manufacturing and an 11-month high in the service sector.

Both of these leading indicators consequently rose out of levels that are historically consistent with periods of economic stress or recession.

Business sentiment was lifted by optimism surrounding a peaking of inflation (and therefore a reduced likelihood of further aggressive monetary policy tightening) and rising customer confidence, as well as signs of capacity constraints lifting, financial conditions easing (linked in turn to the calming of markets since last autumn’s budget), and reduced concerns over recessions both at home and abroad.

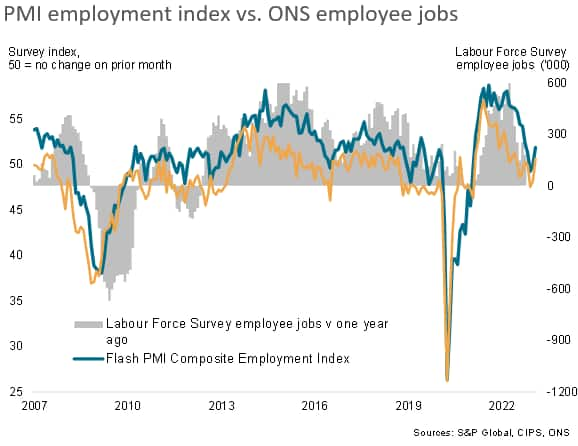

Job creation picks up

Another positive signal for the outlook was provided by the survey’s employment index, which registered the fastest rise in payroll numbers since November, fueled by rising service sector employment. While employment is often viewed as a lagging indicator, the more positive picture of an improving hiring trend was corroborated by a rise in the survey’s backlogs of work index, which provides a more forward-looking insight into capacity needs (and therefore tends to lead changes in employment).

Price pressures at 16-month low

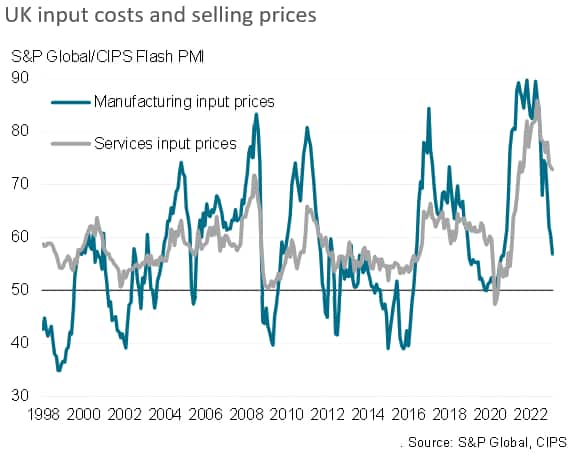

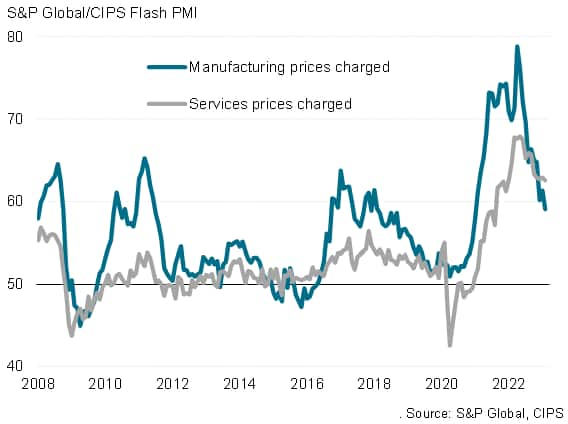

While the February surveys also showed input costs and selling prices rising at slower rates across both manufacturing and services, which should help bring consumer price inflation down further from the 10.1% annual rate seen in January, the latest easing in the overall rate of inflation signaled was only very modest. In particular, input cost and selling price inflation rates remain especially elevated in the service sector.

While it is common for service sector inflation to lag that of the manufacturing sector, there remains some concern over the stickiness of the rates of inflation indicated for the service sector in February, especially as many firms associated this with rising wage pressures, which will be of concern to those policymakers worried about wage-price spirals.

Further rate hikes ahead

The stronger than expected survey findings clearly put a 25 basis point rise by the Bank of England firmly on the table for March, taking the Bank Rate to 4.25%, and could see markets pricing in more rate hikes in the coming months.

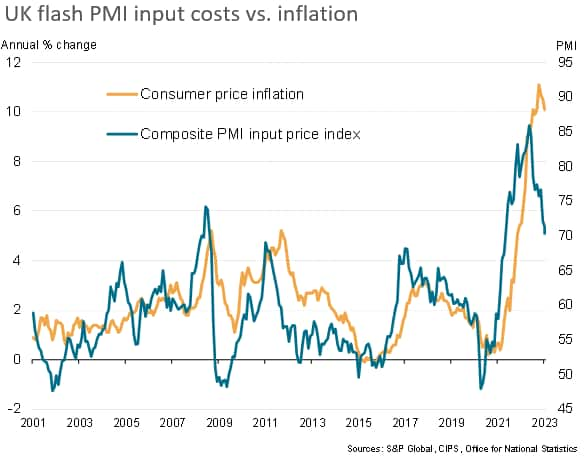

Not only will policymakers be encouraged by the resilience of business activity, optimism and demand, but the persistent elevated nature of the survey’s price gauges is likely to fuel concerns about persistent high inflation in the months ahead. Even though the survey’s composite input cost index has fallen sharply from its peak last year, it remains higher than at any time since mid-2008 and consistent with inflation running well above the Bank’s 2% target.

The concern is, however, that further rate hikes will cause business confidence to slide lower again, meaning the risk of recession is merely pushed out to later in the year.

Source: S&P Global

Legal Notice: The information in this article is intended for information purposes only. It is not intended for professional information purposes specific to a person or an institution. Every institution has different requirements because of its own circumstances even though they bear a resemblance to each other. Consequently, it is your interest to consult on an expert before taking a decision based on information stated in this article and putting into practice. Neither MuhasebeNews nor related person or institutions are not responsible for any damages or losses that might occur in consequence of the use of the information in this article by private or formal, real or legal person and institutions.